From Stately Affairs To Super-tracks

By MB Kalinich

Jerome Park (1866), Rockingham (1906), Bowie (1914), Ak-Sar-ben (1919), Beulah (1923), Longacres (1933), Atlantic City (1946) … By the early 20th century, there were dozens and dozens of Thoroughbred race tracks across the America. As the sport of horse racing became as popular as baseball and boxing even more tracks were opened.

Hialeah (1925) in Florida, registered as a National Historic Landmark in 1978, saw the likes of Needles, Carry Back and Citation run in the Florida Derby, renamed the Flamingo in 1937 in honor of the iconic pink flamingos. The Flamingo was considered the premier Triple Crown prep race for 2-year-olds. In 2004, Hialeah ceased Thoroughbred racing due to losing its state license. After adding a casino, the facility reopened in 2009 sans stables (demolished in 2007) with Quarterhorse racing only to close a year later. Once the jewel of south Florida racing, Hialeah reopened in 2013 with a new casino offering Quarterhorse racing with only a winter meet.

California’s circuit would shrink when historic Hollywood Park (1938) closed to much fanfare in 2013 to be developed as a football stadium. The historic track would survive a 1949 fire that destroyed the clubhouse and grandstand but would succumb to a bid for its prime location that began in 1995. The site of the first Breeders’ Cup day in 1984, Hollywood Park hosted many important G1 races such as the Hollywood Gold Cup. Seabiscuit would make history by winning the inaugural Gold Cup in 1938. Other great champions to follow in his hoof steps included Challedon (1940), Citation (1951), Swaps (1956), AckAck (1971) and Affirmed (1979).

As The Sun Sets, Simulcasting Rises

Oregon’s circuit would almost disappear with nary a sound when after their 2018-2019 winter meet concluded it was quietly announced in April that was the last at TSG’s Portland Meadows (1946). The facility is not completely closed converting into an Xpressbet (a TSG company) Lounge that opened on July 1. The facility also offers “Social Gaming” Poker.

As reported in The Oregonian, The Oregon Racing Commission approved a three-year license for another location, Grants Pass, in late March without hearing a word of objection from Portland Meadows’ owners, according to Jack McGrail, the commission’s executive director. Dutch Bros. Coffee chief executive Travis Boersma has secured a commercial racing license for a track in Grants Pass Downs, including the rights for off-track betting and to simulcast races held elsewhere, a major money-maker for tracks. The decision wouldn’t preclude Portland Meadows from seeking a renewal of its own license, which expired in June. But it’s unlikely Oregon could sustain two tracks through split simulcasting revenue, said McGrail said. Portland Meadows is expected to be sold for development.

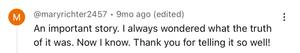

The closing of historic Suffolk Downs was particularly painful and ended a tradition in Boston. Seabiscuit made his debut at Suffolk Downs five days after the track opened. He finished fourth in the first running of the Mayflower Stakes. Tom Smith first saw Seabiscuit run there and brought the little colt to Charles Howard’s attention.

Opened in 1935, Suffolk Downs was built in just 62 days on the mud flats of East Boston by Joseph A. Tomasello for a cost of $2 million. It was the fourth track in New England and had the nation’s first concrete grandstand with the largest clubhouse in the world. Steeped in history, War Admiral, First Fiddle and Whirlaway won big at Suffolk Downs. Bing Crosby had a stable at the track. In later years, champion Cigar won two races on the hallowed track. He was such a star that in 1996 he got a state police escort to the track on what Boston declared “Cigar Day.”

Suffolk Downs was sold for real estate development in 2014 after it was passed over for the lone Boston-area casino license. But Sterling Suffolk Racecourse retained the racing and simulcasting operation, allowing the track to host abbreviated meets from 2015-19. Demolition of the property began July 1 with the stable area. Though the wrecking ball and the excavators will be present, simulcasting operations will continue in the main building of Suffolk Downs.

150-year-old Pimlico, one of three Triple Crown tracks, is in danger of closing as Maryland sees it’s circuit possibly shrink from eleven to two–Laurel Park and State Fair meet at Timonium Fairgrounds. The history of Pimlico is incomparable as the track has seen countless champions including the two greatest match races in American horse racing. Seabiscuit ran his great race against War Admiral there in 1938. But another lesser known race took place at Pimlico 61 years before. The Great Sweepstakes of 1877 between three Hall of Fame greats–Parole, Ten Broech and 1875 Preakness winner, Tom Ochiltree–brought fans from across the country to Pimlico. The United States Congress even adjourned and chartered a train to attend. This race is immortalized in gilt bas relief sculpture on the side of Pimlico’s clubhouse.

The Upside

On the upside, Colonial Downs in New Kent County, Virginia, is holding their first meet in five years. Mainly on the turf, the meet will last 15 days and offers patrons free admission. Following the trend in off-track betting, Colonial also opened three Rosie’s Emporium locations. On the swing is Arizona Downs. After pouring millions of dollars into renovating the old Yavapai Downs facility, the meet that began May 24 and was to run until July 21 was cut short ending June 23. The owners reportedly claim the early closing was due to lack of revenue because they were unable to reach an agreement with Monarch Content Management (a Stronach Group (TSG) company) over simulcasting rights. As America witnesses the closing of more tracks there is discussion of consolidating racing to even fewer venues and the mention of Supertracks.

The Big Acquisitions

By 2000, two companies began purchasing racetracks across North America: Magna Entertainment Corp. (MEC now TSG), headed by president Frank Stronach, and Churchill Downs Inc. (CDI) with Tom Meeker at the helm. Between the two companies, MEC and CDI then owned 13 racetracks and controlled 40 percent of the market share of racing’s $13.7 billion gambling business.

Churchill Downs had spent more than $325 million in cash or stock to acquire Hollywood Park, Calder Race Course, Ellis Park and Arlington International. These tracks would join CDI’s stable that included Hoosier Park and Churchill Downs. Hollywood Park was sold and developed. A casino was added to Calder and after rebuilding the racing facility, that part was leased to TSG and renamed Gulfstream West. New private owners recently purchased Ellis Park and opened a new meet after investing in renovations. Focusing their interest and capital on Churchill Downs and Arlington International, CDI recently sold Ellis Park to private owners.

With its elegant and state-of-the-art facility Arlington is a CDI success story that affords fans of all levels a world-class experience. Arlington holds both a historic and modern importance in the sport. Opening in 1927 Arlington solidified its place in the racing world by installing the first all-electric totalizer and the largest closed-circuit color TV in sports. Rebuilding after a devastating fire in 1985, Arlington rose from the ashes to witness more history. On July 13, 1996, Cigar came to Arlington to win his 16th consecutive race to tie Citation’s record. Inaugurated in 1981, the Arlington Million was the world’s first million-dollar race. In 2002 Arlington hosted the Breeders Cup. And in 2007, the facility was the first in the CDI group to install a synthetic surface.

CDI has spent millions on renovations and expansion of their marquee facility, Churchill Downs. In 2017, CDI spent $32 million to improve parking and transportation. A year later they had spent $70 million on the project to include more than 1,800 seats through 32 new suites and a third-floor grandstand. “The entertainment options that everybody has are changing, expanding, people want a great experience. That’s why they come to the Derby, that’s why they come to Churchill Downs, it’s for that experience,” said Kevin Flanery, president of Churchill Downs Racetrack.

“We have this rich history that we want to celebrate, but we also know that we have to keep up with the times.” Although CDI has kept the iconic twin spires in tact the historic esthetic of the facility may have been forsaken for modern amenities and more resembles history crammed between two cruise ships.

CDI has also expanded with their TwinSpires products and acquisition of BetAmerica, an ADW CDI is restructuring for sports betting. In 2018, CDI purchased Ocean Downs, a harness racing facility near Maryland’s resort town of Ocean City.

Since 1998, Stronach and MEC had spent more than $300 million to buy Santa Anita, Golden Gate Fields and Bay Meadows in California, Gulfstream Park in Florida, Remington Park in Oklahoma and Thistledown and Great Lakes Downs in Ohio. Stronach also wished to add Monmouth Park in New Jersey. The company also showed an interest in Suffolk Downs and Penn National. MEC and Frank Stronach would spend an additional $117.5 million to acquire Maryland’s racing interests that included Bowie Training Facility, Laurel Park and Triple Crown track, Pimlico. With all three facilities in failing condition, Stronach would promise to make multi-million dollar investments in improvements. Upon purchase of Gulfstream, Stronach immediately leveled the facility and replaced it with a state-of-the-art clubhouse with world-class amenities surrounded by a multi-use complex at the cost of over $200 million. Stronach has used the term “Supertrack” in describing plans for Santa Anita, Gulfstream and Laurel.

After a 2009 bankruptcy, the sale of assets and the closing of Portland Meadows, Stronach, now TSG, owns five Thoroughbred tracks and a Standardbred track, Rosecroft, in Maryland. TSG also owns many off-track betting facilities (eight in Maryland) and complementary businesses such as Amtote, Xpressbet and Monarch Content Management (MCM). The company continues to expand in off-track betting facilities and simulcasting.

Currently, TSG has stated their focus on the future is to consolidate racing in Maryland to Laurel Park and move the Preakness to that facility. The company has invested millions to add style and amenities to Laurel to attract newer, more committed patrons. TSG has revived the historic Washington D.C. International at Laurel Park, the precursor to the Breeders’ Cup. The company continues to renovate and expand Gulfstream Park with plans to do the same at Laurel and Santa Anita. TSG also leases the track entity of Calder from CDI using the name Gulfstream West while CDI retains the casino.

State-owned New York racing will see changes with the building of a new hockey complex adjacent to Belmont Park. The developers propose to bring a 19,000-seat arena, 250-room hotel and 435,000-square-foot retail village to 43 acres of the horse racing track’s parking lots. Horseracing Insider reported that the final approval process began in August for the New York Islanders Arena at Belmont. Jon Ledecky, co-owner of the Islanders, said at a season ticket-holders, “Actual ceremony after Labor Day. Work on the arena might begin in next two weeks. One more hurdle to pass on August 8. Building ‘A’ done deal.”

NYRA officials stated that Belmont’s plans would remain secret until the revelation of the Islanders’ final plan. NYRA itself has had plans for a major renovation of the paddock with a multi-story horseshoe shaped building circling the saddling area and walking ring. It will contain boxes and suites, as well as food and beverage facilities. While the Islanders may encroach on some part of the backyard, NYRA officials assure the backyard will still exist, though its configuration will most likely be different. The New York Arena Partners will build its major projects, the arena and its food, beverage and entertainment space, the retail village and a hotel in mostly vacant parking lots used by racing fans once a year on Belmont Stakes day. “Belmont will be Gulfstream Park on steroids,” said NYRA board member Michael Dubb in December 2017.

How will consolidation affect:

The Horses

In 1994, 44,143 registered Thoroughbred foals were born in North America. By 2018 that number had dropped by more than 50 percent. The Jockey Club just released a report that the 2020 foal crop will be lower than estimated. Projecting a 2020 foal crop of 20,500, The Jockey Club also announced a revision to the 2019 foal crop from 21,500 to 20,800. This adjustment is based on the number of Live Foal Reports received to date for the 2019 foaling year.

Fewer horses could mean fewer races at existing tracks. And could mean horses that run more often. As we see more stallions retire to stud as 3- and 4-year-olds, it leaves the bulk of racing on geldings, ridglings and mares not of breeding quality. Consolidation to fewer tracks would accommodate the shrinking foal crop, provide fuller cards, a better quality product for the players, and enable horses to run less and retire earlier.

Trainers and Training

The more tracks that consolidate the fewer on-site stalls that will become available for trainers. Many track facilities providing stalls encourage trainers to run horses in-state in order to keep space. Limiting facilities many reduced opportunities for trainers and owners to place their horses. However, there could be an increase in purses.

There will also be a need for training facilities to complement tracks for stabling and training. With San Luis Rey near Santa Anita, Palm Meadows near Gulf Stream and hopes to revive Bowie near Laurel Park, TSG is providing these facilities. But are they enough? The smaller trainers may not be able to afford private facilities such as Fair Hill in Cecil County Maryland. Increased purses might make this more affordable.

The Surface

Thoroughbred horse racing has seen huge controversy over track surface in the first half of 2019. There is much discussion regarding safety and the quality of dirt surfaces at the many facilities as no two seem to be alike. But some experts feel the over 100-year-old use of dirt surfaces has become obsolete. Many are quick to compare safety statistics with those of British and European racing held almost entirely on grass. Turf will always be the safest surface. But turf-only races like in Europe and Australia are likely not an option.

Comparing statistics to American and international tracks using synthetic surfaces is notable. Two British racetracks, Wolverhampton and Newcastle, tracks where the state-of-the-art version of Tapeta 10 is in use have significant reduction in incidents. According to statistics supplied by Arena Racing Company in 2018, which owns both tracks, the rate of fatalities per 1,000 starters at Wolverhampton since 2016 has been 0.07. At Newcastle, the number is 0.08. There has not been a fatality at Newcastle since October 2017. Over that time, there have been 3,096 starters. There have been 3,299 starters at Wolverhampton since the last fatalities, in December 2017.

There is buzz about changing all dirt surfaces to synthetic. Currently, Arlington International, Woodbine, Turfway, Presque Isle and Golden Gate are among the few tracks still running on synthetic. Golden Gate is the last California track remaining under the old state mandate. When Santa Anita made the transition under the California mandate they quickly switched back as soon as it was possible claiming the Pro-Ride broke down too quickly in the San Gabriel Valley climate.

On August 11, 2019, The Jockey Club’s 67th annual Round Table Conference on Matters Pertaining to Racing brought several hundred industry leaders together. The first portion of the Round Table addressed the need for a greater emphasis on the safety of racing surfaces, including a proposal for a new surface that can better blend the properties of dirt and synthetics. This would be ideal but would take years to test and perfect. The need to make surfaces at all tracks safe is imminent.

Regardless of surface the majority of training takes place on the main track. There is an opinion that consolidation with year round racing schedules may cause overuse and break down the integrity of the surface. More training facilities will alleviate this issue. Synthetic surfaces are more costly to maintain and replace. However, that expense is insignificant compared to the injury, loss of equine life, danger to human riders and the overall image of the sport.

The Players

According to the National Thoroughbred Racing Association (NTRA) Handle and Takeout on Thoroughbred racing grew 3.3% in 2018, the first full year that the industry operated under the modernized regulations regarding the withholding and reporting of pari-mutuel proceeds adopted by U.S. Treasury Department and Internal Revenue Service (IRS) in September 2017. This rise reflects an increased engagement from an expanding fan base many of whom experience the game through technology. Although their wagering may not be as invested as traditional players their numbers put more money in the pool.

The Thoroughbred Idea Foundation remarked in their January blog “Takeout 101” that participation of these smaller/newer players enables bigger players to wager more. The rise in market liquidity creates greater opportunity for professionals to wager more. A robust entry-level market for racing yields more participation from the top end of the market. Professional-level players become annuities for racing, contributing hundreds of thousands to handle every year as long as they’re in the game. Without an influx of money from new players, professionals will bet less, and there will be no new group of professionals to replace them creating a vacuum where there should be a thriving industry. Lowering the cost of racing wagering will result in increased play. It is the most sensible approach to the industry’s current pricing problem.

There is no doubt as to the consensus that takeout across the board is too high. The gambling term “the house wins” has no greater meaning than in horse racing. In order to keep the clubhouse in a stylish manner more money is being held by the house than in other gambling games. That number now, however, stifles the economic growth of the racing industry by not allowing enough cash to flow back to players, choking bankrolls and driving them towards alternatives that are easier to understand, better priced and offer widely available, inexpensive data. Horse racing’s response to increased competition in the gambling space has been to present the same product while raising prices. Economists agree, if racing were priced more competitively, handle would grow, more players would be attracted to the game and existing customers would bet more.

Technology provides a supporting economic base for the industry as new fans are remotely exposed to the game. However, that same technology can distract that customer to invest in a different product. Providing a live racing experience for a new player is key to marketing racing’s product. Consolidation may limit that experience thus decreasing their fiscal input. While some players agree consolidation will provide a better betting product some fear it will bring a monopoly and higher takeout. Regardless, the sport must address the issue of high takeout to keep their existing base and encourage new players’ investment.

Simulcasting

Simulcasting is complicated but it didn’t start out that way. The term “simulcast” was first used in the 1940s when a program was transmitted on both television and radio in tandem. With the growing popularity of television, simulcasting referred to broadcasting an event on multiple channels at the same time. Simulcasting and the sport of racing grew simultaneously as the medium of television and the Sport of Kings reached the masses. Racetracks showed their own races on closed circuit TV for the convenience of patrons who were dining in the clubhouse or inside placing a bet. But patrons still couldn’t watch or bet on races at other racetracks where they were.

Las Vegas, the only state in the country with legalized betting, had off-track betting parlors although many states were running underground versions of OTBs across the country but no live racing and no simulcasting. The rest of the United States had no off-track betting. A strong push for legalized off-track betting, coupled with the use of simulcast, was made to increase revenues for Thoroughbred racing. In 1978, off-track betting was formalized legally with certain stipulations. Revenues generated in-house were to be shared amongst the horsemen, track owners and the state.

After the golden age of the 1970s, attendance at racetracks saw a decline but the novelty of simulcast and off-track betting exploded. Overall revenues within the sport grew exponentially. Through the 1980s and 1990s, simulcast wagering and OTBs began to surge across the United States and the world. Countries such as Japan, Canada and Great Britain expanded their offerings with parlors and independent shops.

Simulcast wagering and OTBs eventually led to a mammoth spike in wagering. The spike was due to the expanded offerings a licensed track could provide to its patrons. No longer limited by the on-track wagers, betting action generated by races were able to be accounted for as all revenue had to be reported to the government. The term “all-sources” was introduced to accommodate the amount of action generated from simulcast wagering and off-track betting.

Now everyone was making a lot of money from simulcasting–the tracks, the horsemen, the states and the licensed jurisdictions that had OTBs. Simulcast and license fees were paid, wagering went up. But the customer still had to go to the track or to an OTB to use the product. How next to expand the market? Computers and the internet were still very new and not very user-friendly. But your television and telephone were. The dawn of TVG and the ADW. These media were available world-wide. Welcome to 21st century horse racing.

In the 2000s there was a laptop on every desk and dining room table. In a few years, a smartphone in every pocket and purse. With websites and apps players now had endless ways to watch racing and place bets–streaming online, on television, at OTBs, through ADWs and at racetracks. With more tracks closing due to lighter attendance and shrinking foal crop to fill the cards, players relied on technology.

The benefits of simulcasting is that it provides the customer with a constant flow of product. A player can watch and bet several races maximizing their return and the track and signal owner’s revenues. It also attracts technology savvy fans who like to keep busy. The limitations of simulcasting are you can’t watch workouts, you can’t visit the paddock or see the post parade. That can only happen at a live facility. The existence of fewer racing venues will limit customers access to pre-race activity that affect handicapping.

Another limitation is blackouts. Most recently some fans saw an interruption of the Travers Stakes broadcast from Saratoga. Because NYRA had made an exclusive broadcasting deal with Fox Sports Network the Travers had limited broadcast. If your cable provider did not carry FSN you were unable to watch live and had to rely on the replay online. If you were a TVG customer you could only watch the live race on their app and on a televised delay after FSN’s coverage had gone off the air.

Customers at Presque Isle Downs, Louisiana Downs, and users of BetAmerica were unable to watch and wager on races from Pimlico including the 2019 Preakness. Those impacted had the option to open accounts with other outlets not affected by the blackout. An ongoing disagreement between racetrack and advance deposit wagering company owners The Stronach Group and Churchill Downs Inc. had led to a blackout of the Pimlico simulcast signal and blackout of other TSG tracks.

Customers experienced a prolonged blackout in 2014 that lasted almost four months as the MidAtlantic Cooperative worked out a simulcast deal representing 23 tracks in 5 states with Monarch Content Management, a Stronach Group company, representing Gulfstream, Santa Anita, Laurel Park, Pimlico, Golden Gate Fields, Tampa Bay Downs, Turf Paradise, and the Meadowlands.

In statements, Monarch’s position was that harness racing tracks and Thoroughbred tracks not offering live meets should pay higher simulcast fees for the Thoroughbred signal because they made less of an overall contribution to the Thoroughbred industry. Although terms of contracts are not made public a source told Bloodhorse that Monarch had been seeking a 20% increase. A settlement was reached in late March 2015 on the blackout that began December 1, 2014. During the blackout players in those markets were unable to view or wager on live races.

ADWs

Once upon a time, you went to the track to watch the race, place your bet and collect your winnings of which the house kept a portion. Or you could have a surrogate aka bookmaker place your bet for you allowing him to take a further percentage of your winnings for the convenience.

Today, you can sit in your living room, watch almost every live race available either on TV or streaming on your computer and place your bet on your phone through an Advanced Deposit Wagering account (ADW). But the player pays for that technology and convenience.

As reported by the think tank, Thoroughbred Idea Foundation, the track has a tremendous cost of doing business–running races while the ADW has fewer costs and a much larger customer base. With less overhead, ADW’s operate on much thinner margins. As such, ADWs can offer a far more appealing price to the customer than the provider of the content, the racetrack itself.

ADW play overall, both to retail and rebated customers, is the strongest growth sector in the business. For some racetracks that also run ADWs, the current situation can incentivize tracks to push customers to their ADW, which is often a more profitable endeavor for the track (it receives half the host fee plus the ADW’s share of the takeout), at the expense of horsemen.

Today, ADW betting accounts for as much as 50% of the handle. The rebate shops, and the takeout reduction they afford gamblers create additional billions in handle and have changed the game. With a 10% rebate, a professional player could easily churn five or 10 times his previous betting, or–in multiple documented examples–100 times.

With that 10% back, even if a player shows a natural 5% loss on bets, the player still earns 5% in profit. By 2018, at least 20% of the total US pari-mutuel racehorse handle is wagered through ADWs offering substantial rebates to high-volume players. Under the current model and with racing’s takeout rates where they are, the rebate is necessary to incentivize these big players. A rebate-less model at today’s takeout rates is not a consideration–high-volume players would abandon the game and handle would decrease.

Sports Betting and Sportsbook

In order to attract a wider customer base many racing facilities and OTBs are installing Sportsbook areas for fans who like to watch and wager on other types of sports. Although sports betting is not legal in all states the hope is it will be and the addition of the platform will boost the racing product. The impact is already evident.

Bill Knauf, vice president of business operations at Monmouth Park, detailed the impact of sports betting at the New Jersey racetrack, explaining it netted a win of $10.5 million from Jan. 1 to June 1, with $7.4 million generated online. “The sports bettor is typically a younger and more diverse audience who are mobile savvy,” Knauf said. He pointed out how night-time simulcast wagering at Monmouth has grown 16% during that same period and how sports bettors prefer fixed-odds wagering.

The Fans

In a world that gives the casual sports fan many different options on what to watch every week, horse racing is putting in extra effort to make a successful comeback. Over the past few years, racing has moved into the new age by embracing social media and finding new ways to bring fans into the sport in innovative ways. BizTech Magazine reported that horse racing and technology experts from Intel and Microsoft say the sport needs to embrace tech to attract a younger fan base. The sport has been slower than others in moving into the digital age, but it is starting to with more ways to experience the big races via mobile applications and virtual reality. However, more needs to be done, these experts say. They point to augmented and virtual reality and blockchain as technologies that could help modernize the sport and make it more engaging for fans that have grown up immersed in digital technology.

In the past few years, the Jockey Club has worked on improving television coverage for the sport to reach a larger market. In addition to having a racing channel, TVG, the sport is seeing more major network coverage by FOX Sports, and NBC with the Road to the Kentucky Derby and Breeders Cup Win and You’re In Challenge. While television and technology offers fans more opportunity to view racing, fans may not be able to experience live racing with fewer racing facilities. The energy and excitement of the sport is something that has to be experienced first hand in order for that to transfer through a computer or TV screen. Attending live horse racing doesn’t need to become a luxury or bucket list item. At a time when American Thoroughbred horse racing desperately needs to build its fan base it can sorely afford to alienate the railbirds and $2 bettor.

Trickledown Economics

In July 2018, The American Horse Council conducted another study on the economic impact of the horse industry in the United States. The horse industry contributes approximately $50 billion in direct economic impact to the U.S. economy, and has a direct employment impact of 988,394 jobs. Additionally, the industry itself contributes $38 billion in direct wages, salaries, and benefits. From those direct effects, the horse industry’s contribution ripples out into other sectors of the economy. Adding these ripple effects results in an estimate of the total contribution of the horse industry to the U.S. economy of $122 billion, and a total employment impact of 1.7 million jobs.

It’s unclear what affect consolidation could have on these figures. However, fewer facilities could mean fewer jobs and less need for support products. The direct impact on the industry could be on equipment sales, health and veterinary supplies, feed, hay, bedding, farm equipment, fuels, shipping, truck and trailer rentals. With less demand the prices will rise. Those costs will be passed down the chain.

National Governance

38 jurisdictions, a lot of acronyms plus one piece of federal legislation. That’s all American Thoroughbred horse racing has to sort through to achieve solidarity.

“We voice our support for the Horseracing Integrity Act of 2019 (HIA), introduced on a bipartisan basis in the House of Representatives and the Senate. … Medication reform is not the only path to safe racing. … Technology, science, and human endeavor must marry their resources to achieve this goal, and we call for the industry to bring to bear the necessary human and capital resources to make this a reality.” With a letter signed by 16 prominent trainers on August 9, 2019, a message was sent to the industry for reform. That reform is Federal legislation, the Horseracing Integrity Act (HIA).

The Senate Resolution, introduced in June by Senators Kirsten Gillibrand (D-NY) and Martha McSally (R-AZ), is nearly identical to the Horseracing Integrity Act of 2019 (H.R. 1754). Introduced by House Reps. Paul Tonko (D-NY) and Andy Barr (R-KY) in March 2019, HIA has already garnered the bipartisan support of more than 100 representatives this Congress. But the Senate version includes the requirement that horse sellers notify buyers if a horse being sold has ever been treated with bisphosphonates, a medication that may be harmful to bone development in young horses.

The bill would create a private, independent horse racing anti-doping authority, the Horseracing Anti-Doping and Medication Control Authority (HADA), responsible for developing and administering a nationwide anti-doping and medication control program for horse racing. HADA will create a set of uniform anti-doping rules, including lists of permitted and prohibited substances and methods, after consulting racing industry representatives and the public, along with taking into consideration international anti-doping standards and veterinarian ethical standards. The new nationwide rules would replace the current patchwork of regulatory systems that govern horseracing’s 38 separate racing jurisdictions.

HADA would be governed by a board composed of six individuals who have demonstrated expertise in a variety of horse-racing areas, six individuals from the United States Anti-Doping Agency, and its chief executive officer. USADA is recognized by Congress as the official anti-doping agency for the U.S. Olympic, Pan American, and Paralympic sports.

On July 10, another very lengthy letter was sent to Rep. Bob Latta, chairman of the Energy & Commerce Subcommittee on Digital Commerce and Consumer Protection, and to Ranking Member U.S. Rep. Jan Schakowsky signed by Stuart Janney III, Chairman The Jockey Club and Craig Fravel, President & CEO Breeders’ Cup. Representing a group known as the Coalition for Horse Racing Integrity (CHRI), the letter stated “We propose the establishment of a new, federally established comprehensive regime of medication control, operated by a private entity composed of members of the United States Anti-Doping Agency (USADA) and the racing industry. The new entity would greatly improve the standards and practices of testing, including expanding out-of-competition testing, increasing research for the detection of new performance-enhancing drugs, and, by law, ceasing the practice of allowing a drug to be administered to a racehorse on the day that it races.”

On August 11, 2019, The Jockey Club’s 67th annual Round Table Conference on Matters Pertaining to Racing brought several hundred industry leaders together. William M. Lear Jr., vice chairman of The Jockey Club, expressed in his talk, Thoroughbred racing is facing a situation that “threatens the very existence of the sport.”

During the course of the two hour and 45 minute session at the Gideon Putnam hotel, a variety of pertinent topics were addressed by speakers, with equine safety issues topping the list as a major push involved support for the Horseracing Integrity Act that has been introduced in the United States House of Representatives and Senate.

“We are facing an existential threat. If our response to that threat is, or even appears to be, business as usual, we’re going to lose,” Lear said. “We will have no chance of fending off the same people that did away with the circus, that did away with dog racing in Florida, because they have their sights on us. … the definition of insanity is doing the same thing over and over again and expecting different results.”

However, there is not a consensus among all in the industry. There is still strong resistance to passage of the HIA among key stakeholders. As reported in the Courier Journal, Eric Hamelback, chief executive officer of the Horsemen’s Benevolent & Protective Association (HBPA), characterized the bill as a plutocratic power play that exploits Santa Anita’s death toll without addressing its causes. “This is a battle of the haves and have-nots,” Hamelback said. “It’s the elitist sort of group and the laymen, the people who are in this industry to make a living, and the industry was not welcoming. “… It makes me angry that they continue to try to utilize the tragedies. To use that as a push for the federal bill is very misleading. The federal rule has nothing to do with any other rule than medication and testing.”

Churchill Downs CEO Bill Carstanjen said in a statement, “We’ve reviewed previous drafts of the proposed federal legislation and have identified serious concerns. We have expressed those concerns to industry constituents and the bill’s sponsor, but they were never addressed. We don’t believe a federal bill is practical, reasonable, or imminent.”

Conclusion

Consolidation seems inevitable. The entities that own the majority of the major tracks also control complementary services such as simulcasting, ADWs and casinos. Independently-owned tracks either comply or close. Casinos and slots have only compounded the problem. Many jurisdictions receive state subsidies rather than direct funding from associated casinos. This requires a lot of political haggling, and hiring lobbyists and lawyers. Money that could be better spent on marketing, something the sport is sorely lacking.

Consolidation may accommodate a shrinking foal crop and give the players a better product but limited options. It may also limit fans access to live racing venues making the sport accessible to elite fans and more difficult to expand the fan base. Consolidation will make fans and players more reliant on technology.

With consolidation and facility expansion historic facilities may be lost and historical esthetic replaced with modern amenities and technology. Part of the marketability of the sport is its history and charm. Overall, without a national consensus regarding safety and rules racing may not survive the squeeze. Without lowering takeout, great marketing and national oversight consolidation of the sport may be irrelevant.

Photos and Images:

Suffolk Downs 1936

Arlington 2019

Pimlico 2019

Jockey Club chart 2019